All businesses that use OFFICIAL RECEIPTS and want to convert their unused official receipts to INVOICES must do so within 30 days of RR 7-2024’s effective date (for manual receipts).

Background: Under the Ease of Paying Tax Act (EOPT), INVOICE shall be the primary written evidence evidencing the sale of goods and services issued to customers. Official receipts are no longer considered primary invoices and shall be considered supplementary documents.

In line with the recent BIR Regulation RR 7-2024 issued on April 12, 2024, effective April 27, 2024, the following regulation applies:

Sec.8 – 2.1: Taxpayer to continue the use of remaining Official Receipt as Supplementary Document

- All unused or unissued Official Receipts may still be used as supplementary document until fully consumed, provided that the phrase “THIS DOCUMENT IS NOT VALID FOR CLAIMING OF INPUT TAX” is stamped on the face of the document upon effectivity date of RR 7-2024 (April 27, 2024)

- Taxpayer is required to have a principal/primary “Invoice” printed apart from the above

Sec.8 – 2.2: Taxpayer to convert and use the remaining “Official Receipts” as “Invoice”

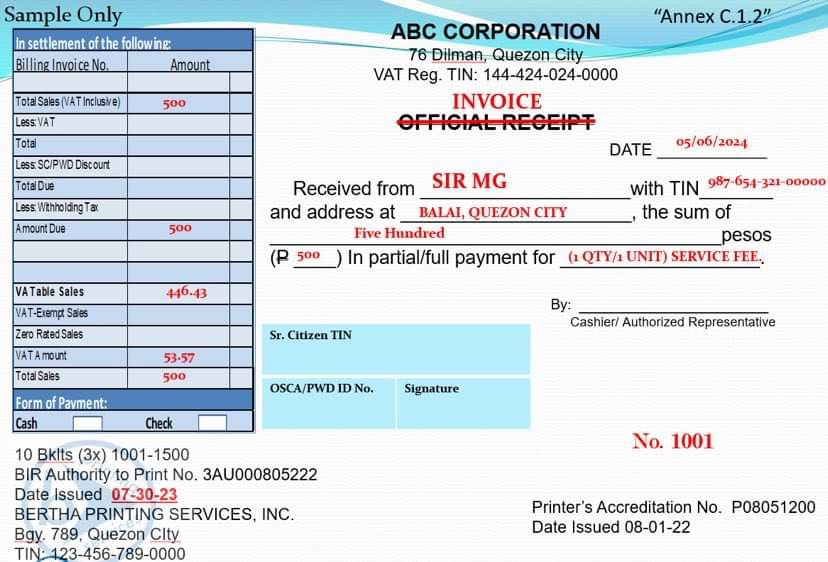

- For ease of doing business, taxpayers shall be allowed to strikethrough the word “Official Receipt (e.g.

Official Receipt) on the face of the manual and loose-leaf printed receipt and stamp “Invoice” and to be issued as Primary Invoice until December 31, 2024.For example:

- Taxpayers are required to submit within 30 days (until May 27, 2024) a notification to the RDO where the head office or the branch is registered.

- Submission of inventory of unused official receipts, indicating the number of booklets and corresponding serial numbers within 30 days (until May 27, 2024)

Reference: RR No.7- 2024.pdf (bir.gov.ph)