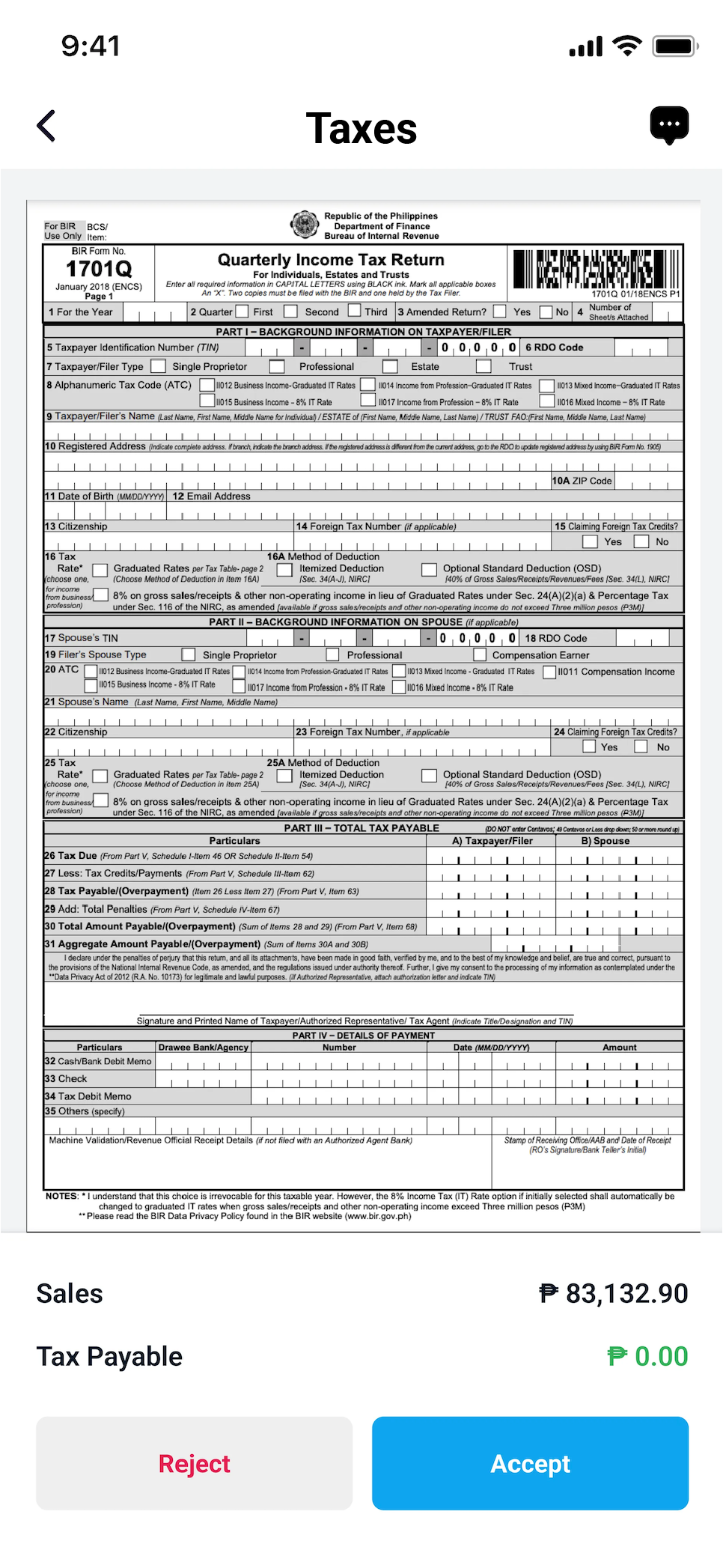

What is this form?

BIR Form 1701Q, or the Quarterly Income Tax Return for Self-Employed Individuals, Estates, and Trusts (including those with both Business and Compensation Income), is a tax form designed for professionals and self-employed individuals operating a sole proprietorship business.

Who needs to file?

This return needs to be filed by individuals listed below:

• Taxpayers who are VAT-exempt with annual revenues not more than 3,000,000.00 (PHP).

• Financial institutions such as banks, finance companies, agents of life insurance companies (foreign), and any related financial intermediaries.

• Franchisees of gas/water utilities, radio/TV broadcasting with revenue not more than ten (10) million pesos.

• Domestic and international air/shipping carriers.

When to file?

The deadline to enter all your transactions for Beppo is ten (10) calendar days after the quarter has closed.

Beppo implements an internal deadline for tax filing services which is different from the deadlines set by the Bureau of Internal Revenue (BIR). This is done to ensure that the filings and/or payments will be made on time.

Thus, the interval between the deadline of Beppo and the BIR is the time where we process your returns for your approval.

How to file?

It’s like having your own bookkeeper, but better! Beppo will keep you on the loop:

- If you have zero tax dues, we will file your tax returns for you!

- If you have a tax due, we will prepare your tax form for your review and you may simply approve the form and pay your taxes in the Beppo app.

- Payment channels accepted for tax payments in Beppo – Credit Card, Maya, UnionBank. Coming Oct 1, 2023: BDO, BPI, Metrobank, RCBC, and Landbank