Freelancing has become an increasingly popular career path in recent years, with more and more people opting to gain more control over their careers and schedules, as well as to get multiple streams of income.

But just like entrepreneurs and full-time employees do, freelancers also need to comply with their tax obligations. In the Philippines, all freelancers and self-employed individuals are required to file their income tax returns to the Bureau of Internal Revenue (BIR). In fact, you have the option to file your taxes: use a graduated income tax rate or simply avail an 8% tax on your gross sales in excess of P250,000.

If it’s your first time doing freelance work and you plan to make this your long-term career, we’ll help you with your tax filing.

Handling taxes becomes simpler with the right help and understanding. Beppo provides both human and tech-driven solutions for all your bookkeeping and tax-related tasks. Whether you prefer to do it yourself or are just too lazy to do it, Beppo is committed to simplifying the process for you.

Why do we pay taxes?

Freelancing can be an incredibly rewarding career path, but it also comes with its own set of responsibilities, one of which is to file and pay your own taxes that’s right, freelancers usually do DIY for taxes. Not only is it a legal requirement but also it can help you establish your credibility, build trust with clients, and get other income sources.

Here’s why you need to pay your taxes:

1. You gain credibility with your clients.

Having a good tax compliance record can also help you establish credibility and trust with clients, which can be important for building and maintaining a successful freelance business.

By showing that you are aware of your tax obligations and that you take them seriously, you can instill confidence in your clients that you are professional and reliable in your business practices.

Having a good tax compliance record can also demonstrate that you are financially stable and that you are not likely to encounter financial difficulties that could impact your ability to deliver your services.

Additionally, if you ever need to provide proof of your income or expenses, having a record of your taxes filed can be helpful in showing your clients that you are transparent in your business dealings.

2. You can charge more for your services.

By demonstrating that you are paying your taxes and investing in your business, you can differentiate yourself from competitors who may not be as financially responsible. This can help you justify charging more for your services.

On top of that, being able to show that you are paying taxes on time can help build a good reputation for your business. This can increase your credibility in the market, making it easier for you to justify your charges.

3. You can present documents to support your loan applications.

Even if you do not earn enough income to owe taxes, it is still important to file a tax return. This will help establish a record of your income and expenses, which can be useful in the event of an audit or if you ever decide to apply for a loan or other financial assistance.

4. You comply with the law and practice good citizenship.

Just as employers file their employees’ taxes for their monthly salary, self-employed individuals need to comply as well. Filing your business taxes is a legal requirement for all freelancers in the Philippines. Not complying with this requirement can result in penalties and fines.

5. You contribute to the country’s development.

By filing and paying your taxes, you are contributing to the development of the country and helping to ensure that necessary public services are available to all citizens. This includes services such as education, healthcare, and infrastructure. As a freelancer, you are a part of the economy and have a responsibility to contribute to the country’s development.

Types Of Taxes In The Philippines You Need To Be Aware Of

In the Philippines, there are several types of taxes that individuals and businesses may be subject to. The following are the most crucial for your freelancing business:

- Income Tax – a tax on a person’s income, emoluments, profits, and other similar sources.

- Percentage Tax – a business tax imposed on those whose gross annual sales or receipts do not exceed P550,000 and are not VAT-registered.

- Annual Business Registration to BIR (BIR 0605) – Self-employed individuals are subject to an annual registration fee to the BIR. The BIR 0605 Annual Registration Fee is a yearly tax filing requirement for individuals, which is worth P500. Failure to comply will result to a penalty of one thousand pesos (P1,000.00), or criminal penalty of imprisonment of not more than six (6) months.

4. Certificate of Final Tax Withheld (BIR Form 2307) – As a freelancer in the Philippines, it’s crucial to be familiar with BIR Form 2307, commonly known as the Certificate of Final Tax Withheld at Source. This form plays a significant role in the taxation process, especially when dealing with withholding tax on income payments.

Freelancers often collaborate with clients and companies that are required to withhold taxes on certain payments. In such cases, clients issue BIR Form 2307 to freelancers, indicating the final taxes withheld. This certificate serves as evidence of the taxes already paid on the freelancer’s behalf and is essential for accurate tax reporting.

Understanding BIR Form 2307 is vital for freelancers, ensuring compliance with tax regulations and facilitating a smooth tax filing process. Make sure to keep a record of these certificates, as they contribute to your overall tax liability at the end of the fiscal year.

Graduated Income Tax vs 8% Income Tax Rate

A graduated income tax system is one in which the tax rate increases as the amount of income increases. In the Philippines, this means that individuals who earn higher incomes will be subject to a higher tax rate than those who earn lower incomes.

Below are the most updated graduated income tax rates under Section 24(A)(2) of the Tax Code of 1997, as amended by R.A. No. 10963:

Table 1:

|

Amount of Taxable Income (effective as of 01 January 2023) |

Rate | |

| Over | But Not Over | |

| – | P250,000 | 0% |

| P250,000 | P400,000 | 15% of the excess over P250,000 |

| P400,000 | P800,000 | P22,500 + 20% of excess over P400,000 |

| P800,000 | P2,000,000 | P102,500 + 25% of excess over P800,000 |

| P2,000,000 | P8,000,000 | P402,500 + 30% of excess over P2,000,000 |

| P8,000,000 | P2,202,500 + 35% of excess over P8,000,000 | |

On the other hand, an 8% income tax rate would mean that self-employed individuals will pay an 8% flat rate tax on the amount of their gross sales that exceeds 250,000 PHP. This option is designed for those whose annual non-operating income does not surpass the 3 million PHP VAT threshold and are not subject to Percentage Tax.

Simply put, the graduated basis for your tax is your net income (gross sales minus expenses) while the 8% tax rate option is a flat rate based on your gross sales. Despite these differences, both the graduated income tax and 8% income tax options are intended for individuals or businesses earning less than three million annually. VAT applies when the three million threshold is exceeded.

A deeper explanation on the 8% Income Tax Rate

When the Tax Reform for Acceleration and Inclusion (TRAIN) Law became effective, many self-employed individuals opted for the 8% Income Tax option. You might ask, how does the new tax option mean to taxpayers?

The eight percentage tax aims to simplify the tax system and make it more efficient. All you have to do is add your gross sales for the year, subtract the non-taxable P250,000, then multiply the difference by 8%.

Since the 8% tax on the personal income only applies to self-employed individuals, those small businesses owned by a corporation may not opt for this option. Under the law, the 8% tax is only applicable to certain types of businesses that are owned by a sole proprietor such as the practice of their profession, consultancy services, pharmacies, or small convenience stores.

Who are eligible for the 8% Income Tax Rate option

The 8% income tax rate is not only limited to doctors, lawyers, architects and engineers. The Revenue Memorandum Order No. 23-2018 states that in order to qualify for the 8% income tax rate option, the following criteria must be meet:

- The individual taxpayer must be a single proprietor, professional, or mixed income earner, with income not exceeding P3,000,000 during the taxable year

- The taxpayer must be registered as a non-VAT filer

- The individual must have the intention to elect the 8% Income Tax Rate upon filing their quarterly income tax return (ITR) for the first quarter of the taxable year, or upon initial registration.

Do note that your intent to elect the 8% tax rate option is the most important. Opting to do this in the first quarter dedicates your tax rate for the rest of the taxable year.

Who are not eligible for the 8% Income Tax Rate option

Not all businesses may opt for the 8% Income Tax Rate option. Check out the list below.

- Corporations that own a business

- Individuals who earn their income through compensation

- Taxpayers who are VAT filers, although this will depend on the amount of gross sales/receipts

- Taxpayers who exceeded the 3 million-peso VAT threshold

- Taxpayers who are subject to other forms of Income Taxes

- Individuals who are considered as partners of GPP (General Professional Partnership).

How to Calculate Income Tax as a Self-Employed Individual

To compute graduated income tax, individuals must first determine their taxable income by subtracting their allowable deductions from their gross income. Allowable deductions include personal exemptions, premium payments for health and/or hospitalization insurance, and contributions to certain government-approved retirement plans.

Next, the individual must determine their tax liability using the tax table provided by the BIR (see table 1). The tax table has different tax brackets, each with a corresponding tax rate. The individual’s taxable income is then matched to the corresponding tax bracket and the tax rate is applied to the taxable income within that bracket.

For example, if an individual’s taxable income is P500,000, the tax rate for the P400,000 to P800,000 bracket is P22,500 + 20% in excess of P400,000. In which case, the tax liability for this individual is P500,000-P400,000 = (P100,000*20%) + P22,500 = P37,500.

Meanwhile, if the taxpayer chooses the 8% tax rate option, the formula is much simpler:

Total income tax = 8%*(Gross annual sales – P250,000).

Using the sample above, computing for your Income Tax using the 8% tax rate option would be: 0.08*(P500,000-P250,000) or P20,000.

If you’re still having trouble on this front, it’s always a good idea to consult a tax professional or use tax software to accurately compute your final tax.

How to File 8% Income Tax Rate Option

If you’re ready to file your 8% income tax as a self-employed individual, here’s how to do it:

Filing 8% Income Tax for Existing Taxpayers

-

- File BIR Form 1905 (Application for Registration Information Update).

- Submit first quarterly Percentage Tax Return and/or quarterly Income Tax Return

- Take note that the BIR’s due date for the renewal of business registration is on the 31st of January.

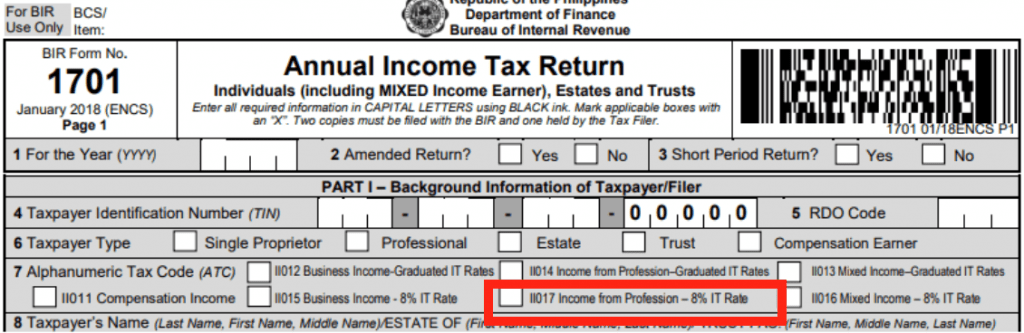

- Also, if you are opting for the 8% income tax rate option, indicate that in the quarterly form under Row 7 (see image below).

Filing 8% Income Tax for New Taxpayers

-

- Secure a TIN or update TIN if you came from private employment.

- File BIR Form 1901 (Application for Registration for Self-Employed and Mixed Income Individuals, Estates/Trusts) and/or BIR Form 1701Q (Quarterly Income Tax Return), and the BIR 1905 (Authority to print receipts)

- You must also pay P500 for the BIR registration to get your BIR 2303 or Certificate of Registration.

- File BIR form 0605 or the payment form

- Use BIR forms 2551Q (Quarterly Percentage Tax Return) and/or BIR form 1701Q if filing for the initial quarter of the taxable year

The Bottomline

Freelancers and self-employed professionals have the same tax obligations as traditional employees. Not paying taxes can lead to penalties and fines, and can result in legal issues. By paying taxes, freelancers and self-employed professionals are contributing to the society and the economy they are part of.

Overall, paying taxes is an important aspect of being a responsible self-employed professional, and it is essential for building a financially stable and secure future.

Paying taxes may not be the most glamorous aspect of running your own business, but it is a necessary one. This is why the Beppo App was developed: to help freelancers take control of their finances and file their taxes in the most convenient way.

Connect with Beppo to know more. Or visit our website https://beppo.com.