Freelancers have the freedom and flexibility that comes with running their own businesses. However, this freedom also comes with a set of responsibilities, one of which is invoicing.

Invoicing is a critical aspect of your freelance business that can impact your financial stability and success. Thanks to technology, you can bill your clients in the most straightforward and hassle-free way by sending automated digital invoices.

This article will uncover what digital invoicing is and how it can help you keep a positive business cash flow. We’ll demonstrate the different invoices you can leverage to bill clients and how to send digital invoices through intuitive platforms like the Beppo App effectively.

What is digital invoicing?

Digital invoicing is a modern way of handling invoices and customer payments. It streamlines the invoicing process by replacing traditional paper-based invoices, eliminating the need for manual data entry and paper-based processes.

Freelancers who leverage digital invoicing significantly reduce the time and costs associated with processing and sending transactional information, so they have more time to attend to their customer’s needs and grow their business.

The Role of BIR Form 2307 in Digital Invoicing

BIR 2307, or the Certificate of Creditable Tax Withheld at Source, plays a crucial role in digital invoicing within the context of taxation in the Philippines. This form is relevant in the digital era as it serves as a supporting document that reflects tax credits for income payments subject to withholding tax.

In digital invoicing, where transactions occur electronically, BIR 2307 helps maintain transparency and accountability. Businesses engaging in digital transactions must provide this certificate to validate that the appropriate amount of tax has been withheld by the payer. This not only ensures compliance with tax regulations but also facilitates accurate reporting and reconciliation between the parties involved.

In summary, BIR 2307 is essential in the digital age as it helps track and verify withholding tax in electronic transactions, promoting tax compliance and transparency in digital invoicing practices.

How Electronic Invoicing Works

Digital invoicing functions the same way as a standard invoice, except that you will be billing your client online. Here’s how an electronically delivered invoice typically works:

- Create your digital invoice. Uses invoicing software or applications like Beppo to generate an electronic invoice, which includes all the required information such as the invoice number, date, goods or professional services provided, and total amount due.

- Send your invoice to the customer. Send the electronic invoice to your client via email, app, or invoicing software.

- Confirm receipt of the digital invoice. Your client shall confirm receipt of the electronic invoice and can view it on their computer or mobile device. They can also download, save, and print digital invoices for their physical records.

- Processing of payment. The client can pay the invoice electronically through secure online payment or direct bank transfer.

- Invoice reconciliation. Track your invoices’ status and receive payment confirmation in real-time through the invoicing software.

Digital invoicing can yield you more benefits than when using traditional paper-based invoicing, such as reducing errors and delays, improving cash flow, and enabling real-time tracking and reconciliation of invoices.

It also helps to reduce paper waste and can improve the efficiency and transparency of the invoicing process for both buyers and sellers.

Why is digital invoicing important for service providers?

As a service provider, you are required to send regular digital invoices to clients. Known as a service invoice, this digital document lists the services you have provided to a client and the amount due for those services. It serves as a record of your work and provides a clear outline of the payment you expect to receive.

Benefits of using digital invoices when billing your services:

- Increased efficiency. Create and send invoices quickly and easily, without the need for manual data entry. This can save you time and effort and allow you to focus on more important business areas.

- Improved accuracy. Reduce the risk of errors in invoicing and ensure that invoices are consistent, accurate, and up-to-date.

- Faster payment. Receive customer payments much faster, since your invoices can be processed and paid online.

- Better cash flow management. Keep track of your invoices and payments more easily, giving you a clearer picture of your cash flow and helping you to manage it more effectively.

- Enhanced customer satisfaction. Provide your customers with a convenient and efficient way to pay for your invoices.

- Enjoy on-time payments. You can send reminders to customers so they won’t forget to pay you on or before the due date.

- Get optimum security. Use finance management tools that get customer payments in the most secure and compliant way.

- Generate accurate records for tax purposes. Automatically calculate taxes based on the information in your invoices. This can save you time and effort, and help to ensure that your tax calculations are accurate and up-to-date.

Difference Between Sales Invoice and Service Invoice

Before sending your clients a detailed digital invoice, ensure you’re sending the right one. Invoices may be classified into two types: a sales invoice and a service invoice. These two invoices serve different purposes and are used in different scenarios.

In hindsight, a sales invoice is typically used when you sell goods or products to your customers, while a service invoice is used when you provide services to your clients.

Here’s a better way of understanding the differences between a sales invoice and a service invoice.

| Sales Invoice | Service Invoice | |

| Purpose | Used to record the sale of goods | Used to record the sale of services |

| Content | Typically includes the details of the goods or products sold, such as quantity, description, and price. | Includes information about the services provided, such as the number of hours worked or the type of services rendered. |

| Payment Terms | May include payment terms such as “due upon receipt” or “net 30 days.” | May include more detailed payment terms based on the specific services provided or terms of the agreement. |

| Delivery | Includes information about delivery and shipping | Does not include delivery information as all services are done online. In some cases, freelancers will charge their customers any travel expenses should they be required to go to their office or site. |

| Customer Information | Sales and service invoices typically include information about the customer, such as their name, address, and contact information. | |

What makes a sales invoice different from a service invoice is the type of transaction being recorded. To avoid confusion, check sales and service invoice templates online to know their difference. There are free service invoice templates available online at your disposal.

Understanding these differences is important for accurate record-keeping and financial reporting.

Types of Invoices for Small Freelance Business

Depending on the requirements, you can send different types of invoices to your clients. Check out the list below.

Standard Invoice

A standard invoice is a formal document detailing the services you have rendered and the amount the client owes for those services.

Here are the key elements that a standard invoice should include:

- Your name and contact information, including your business name, address, phone number, and email address.

- The client’s name and contact information.

- A clear and concise description of the services you provided, including the date that the work was completed.

- The amount that the client owes, including any taxes or fees.

- The payment terms, such as the due date and method of payment.

Credit Invoice

A credit invoice records a credit or refund to a customer. This invoice is typically issued when a customer returns goods or cancels a service.

Typically, a credit invoice is used when the original invoice contains incorrect information related to pricing, changes in service delivery, or service descriptions.

Debit Invoice

A debit invoice is used to record a debit or charge to a customer. This type of invoice is typically issued when a customer owes a debt or is charged a fee.

You may use a debit invoice to remind the client that they have an outstanding balance and that you would like to do a quick follow-up on their payment for the services you rendered.

Timesheet Invoice

A timesheet invoice is used to record the hours worked by an employee or contractor. It typically includes details such as the date, the number of hours you worked, the rate of pay, and the total amount due.

This form of invoice is usually generated based on the information recorded in your timesheets, which track the amount of time you spent on specific tasks or projects.

Recurring Invoice

A recurring invoice is an automated invoice that is sent to a customer regularly, such as monthly or quarterly. It is used for routinely billed services, especially if the client requires you to do a recurring task such as social media content or blog posts. Usually, the amount is the same across all billing cycles in a recurring invoice.

Proforma Invoice

A proforma invoice is a preliminary invoice issued before the sale of goods or services. It is typically used to secure a sale or to estimate the cost of goods or services to a customer.

Unlike a standard invoice, which is used to request payment for goods or services after they have been delivered, a proforma invoice is not a demand for payment. Instead, it estimates what the final invoice will look like and is often used to secure financing or confirm the transaction details before the task or project is fulfilled.

Overdue Invoice

An overdue invoice is an invoice that has not been paid by the due date. This type of invoice is typically used to remind a customer of a late payment or to indicate that further action may be taken if the payment is not received.

Overdue invoices can have a negative impact on the cash flow and financial health of your business, as they represent uncollected revenue. In that regard, you need effective invoicing and payment collection processes to ensure timely payment of their bills and minimize the number of overdue invoices.

Retainer Invoice

A retainer invoice is used to record bills for services that are provided on a retainer basis. This type of invoice is typically issued in advance to secure a block of time or resources for a client.

Generate A Digital Invoice for Clients

As a freelancer, you need all the tools you can use to send digital invoices to clients easily and efficiently. This is where Beppo comes in. Beppo is a financial management solution that allows you to track money, send invoices, and manage your taxes on the all-in-one mobile app.

Leverage Beppo for your various needs.

Here are the features:

- Cash Book – Manage and track your income and expenses for an easier overview of your cash flow.

- Tax Projection – See an estimate of your taxes based on your income and expenses.

- Invoice – Send invoices to your clients via SMS, Viber, and Email.

- Budgeting – Set limits and automate your budgeting.

- Assisted Tax Filing – Get live support from tax experts as you prepare your taxes.

- In-App Community – Engage with other freelancers within the community.

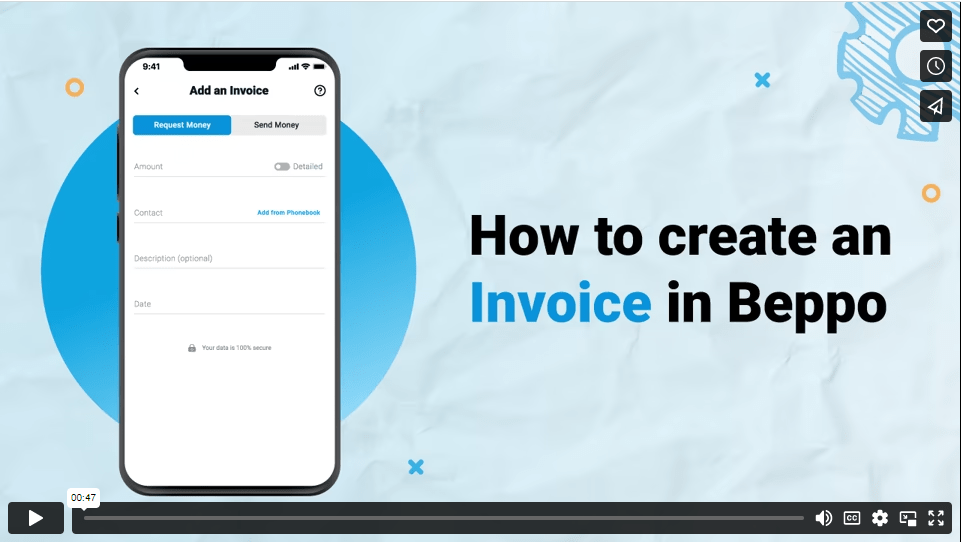

Here’s to create a digital invoice using the Beppo app:

Step 1: Click ‘Create an Invoice.’

Step 2: Select whether you want to Request Money or Send Money. For this example, select ‘Request Money.’

Step 3: Toggle ‘Item Breakdown’ to list the services you’ve rendered to the client and provide additional information requested such as the amount and type of service

Step 4: Add the contact details of the person you want to send the invoice to.

Step 5: Review the content and Click ‘Send to Contact.’ You will be asked to choose how to send your invoice. Select from SMS, Email, or Messaging Apps.

Step 6: Confirm with the client if they are able to view your invoice.

In Conclusion

Accurate and timely invoicing is crucial for maintaining a positive cash flow and ensuring that payments are received on time. Digital invoicing has made the invoicing process faster and more efficient, reducing the potential for errors and delays.

By taking advantage of the latest technology and best practices, you can ensure that their invoicing processes are effective and efficient, and contribute to the overall success of your operations.

Connect with Beppo to know more: https://bit.ly/bookacall-beppo. Or visit our website https://beppo.com.