Transferring your RDO (Revenue District Office) in the Philippines typically involves changing your tax jurisdiction or tax residence. This process is important when you move to a different location or want to update your tax records with the tax office that corresponds to your new address. Here are the steps to transfer your RDO:

- Update your address with the BIR (Bureau of Internal Revenue):

- Visit the nearest BIR branch office in your new location.

- Fill out the necessary forms to update your tax records with your new address.

- You may need to provide proof of your new address, such as a utility bill or lease agreement.

- Obtain a Transfer Certificate of Title (TCT) or Tax Clearance Certificate (TCC):

- In some cases, you may need to secure a TCT or TCC from your old RDO.

- This certificate will indicate that you have cleared all your tax obligations in your previous RDO.

- Pay any outstanding taxes:

- Make sure you have settled any outstanding taxes with your old RDO before transferring.

- This may include income tax, business tax, or other tax liabilities.

- Visit the new RDO:

- Go to the new RDO that corresponds to your new address.

- Fill out any required forms for the transfer and provide the necessary documentation.

- Attend an orientation or seminar (if required):

- Some RDOs may require you to attend a brief orientation or seminar, particularly if you are transferring your business registration.

- Wait for the approval:

- The new RDO will process your transfer request and update your records in their system.

- You will be issued a new Certificate of Registration (COR) reflecting your new RDO details.

- Update your tax compliance:

- Ensure that you comply with the tax requirements of your new RDO, including filing your taxes, making payments, and submitting any necessary reports.

Please note that the specific requirements and procedures for transferring your RDO may vary depending on your circumstances and the policies of the respective RDOs. It’s advisable to contact your old and new RDOs for precise instructions on how to transfer your RDO and to get information about any fees or additional documents required. It’s also recommended to consult with a tax professional or accountant for assistance in the process.

How can I process an RDO transfer online?

As of BIR’s last update in January 2022, the process of transferring your RDO (Revenue District Office) online in the Philippines was not yet fully established.

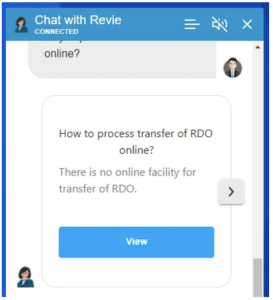

Here’s a response from BIR’s chatbot, Revie, informing that there are currently no online options for RDO transfer at the moment.

Source: https://www.bir.gov.ph/

However, government agencies, including the Bureau of Internal Revenue (BIR), have been making efforts to digitize and streamline their services. Online transactions and services have been gradually introduced to make processes more convenient for taxpayers.

Here are some steps you can take to potentially initiate an RDO transfer online:

- Visit the BIR Website:

- Start by visiting the official website of the Bureau of Internal Revenue (BIR) at https://www.bir.gov.ph.

- Check for Online Services:

- Look for any online services related to address or RDO changes. BIR periodically updates its website and adds new online features, so check for any developments in online services.

- Contact BIR Customer Service:

- If you can’t find the necessary online forms or procedures on the website, contact BIR customer service for assistance. They may provide guidance on how to request an RDO transfer online.

- Use the eBIRForms System:

- The BIR has introduced the eBIRForms system, which allows taxpayers to file various tax forms electronically. While this may not directly facilitate RDO transfers, it can be a useful resource for managing your tax obligations online.

- Stay Informed:

- Keep yourself updated on changes in BIR policies and services. New online features may be introduced over time, making the process more streamlined and accessible.

It’s important to note that the availability of online services and specific procedures for RDO transfers may have evolved since the last update in January 2022. We recommend visiting the official BIR website or contacting their customer service for the most up-to-date information on online RDO transfer processes and requirements.

Additionally, consider consulting with a tax professional or accountant from one of our Partner Firms, as they can provide guidance on the latest procedures and requirements for RDO transfers, including any online options that may have been introduced since my last knowledge update.