Understanding and filing taxes can be confusing. If you’re self-employed in the Philippines, it’s essential to know which BIR forms you need: 1701A, 1701, 1701Q, 2551Q, and 0605.

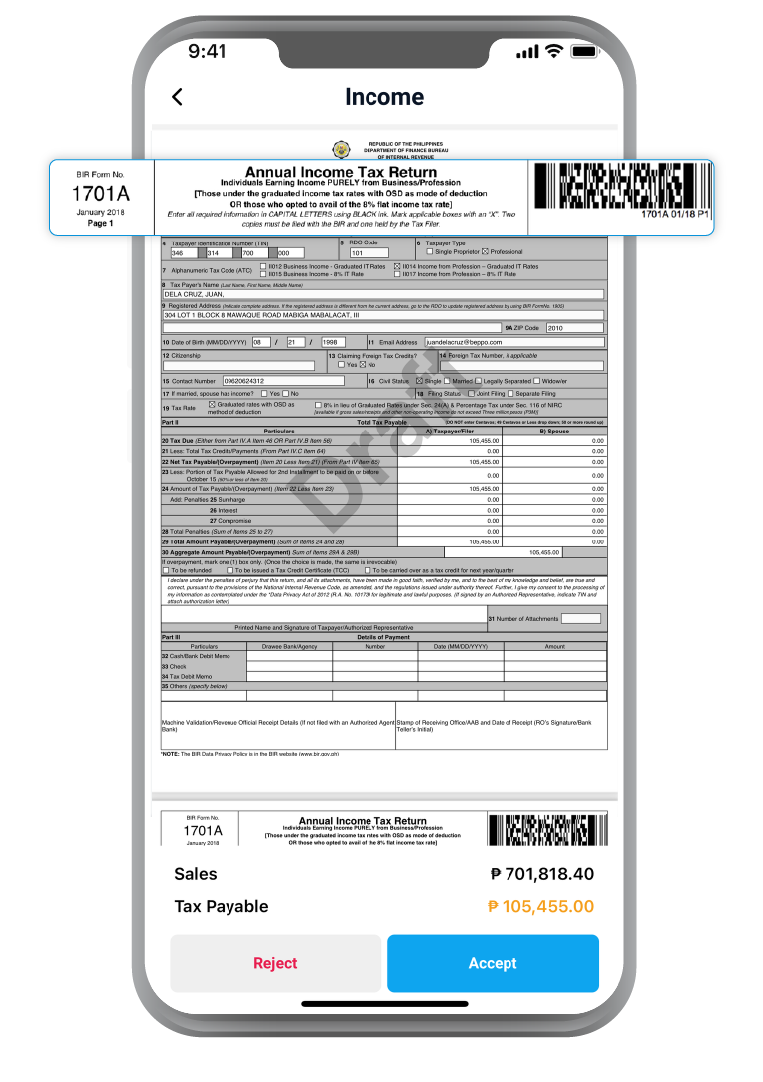

BIR Form 1701A

Self-employed professionals, freelancers, independent contractors and entrepreneurs, you’ll likely need the BIR Form 1701A. This form is your yearly tax submission if your income is primarily from your business or professional activities.

Check full view of BIR Form 1701A here.

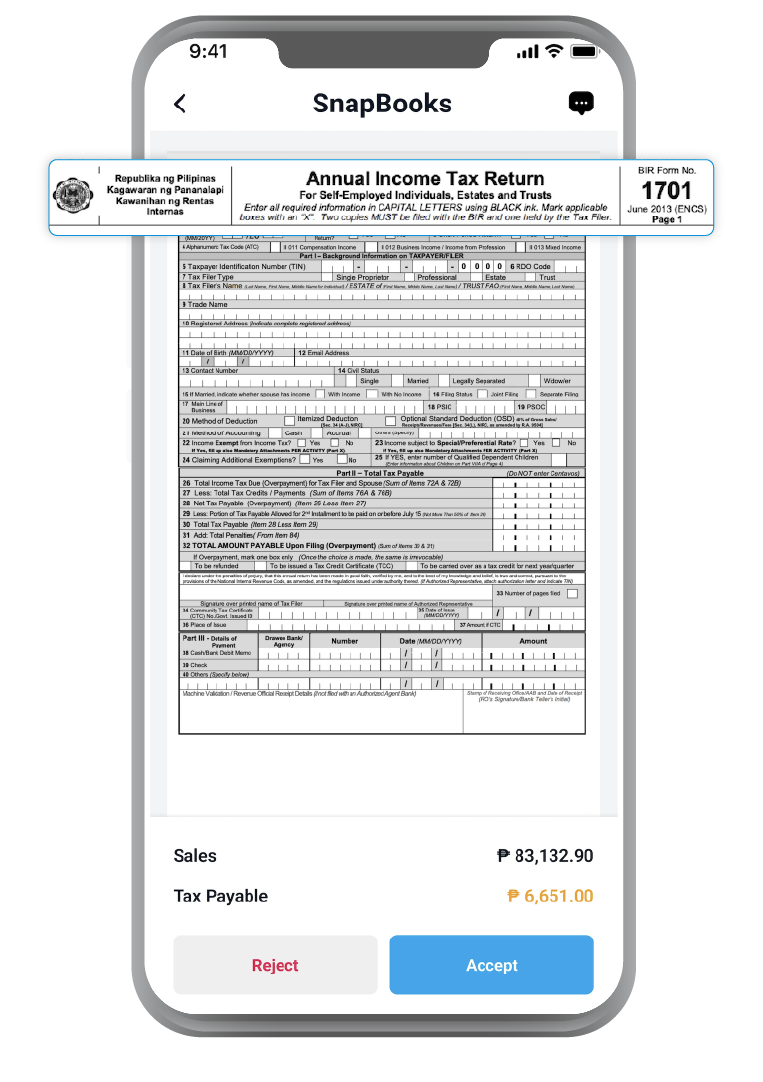

BIR Form 1701

The BIR Form 1701 is another annual tax form, but it’s tailored for those self-employed individuals, estates, and trusts that have both compensation and business income. It’s crucial to know whether you need the 1701 or 1701A form for your yearly filing.

Check full view of BIR Form 1701 here.

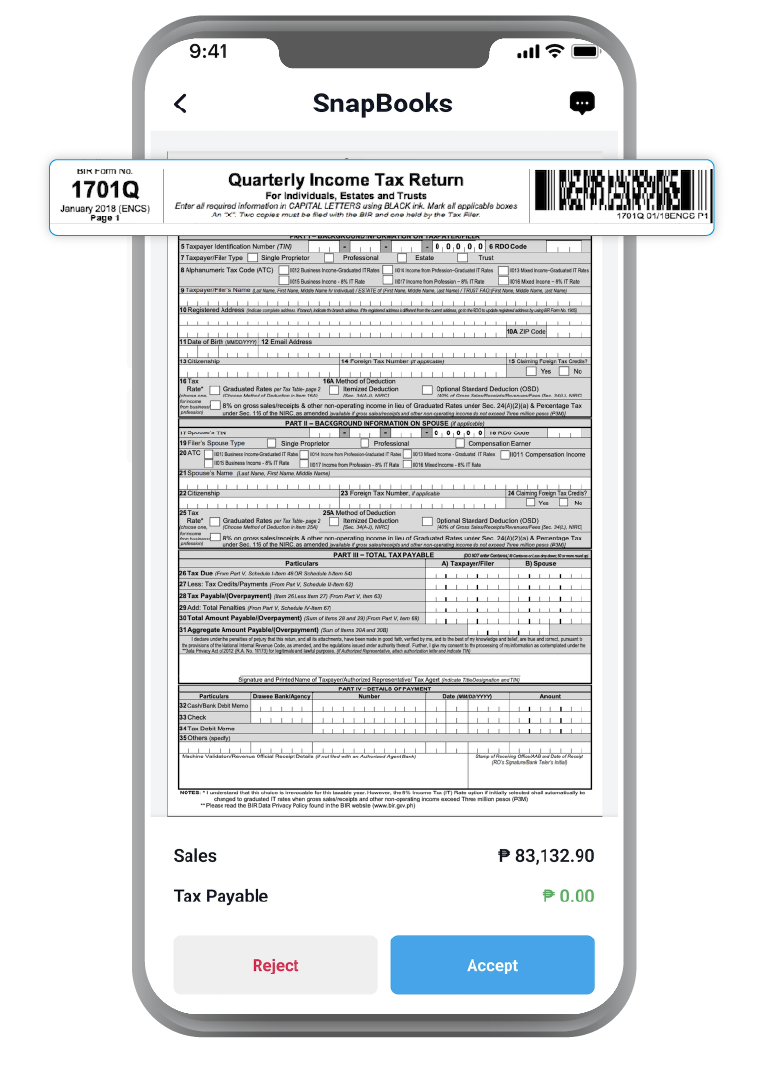

BIR Form 1701Q

For those quarterly check-ins on your income tax, you’ll use the BIR Form 1701Q. This form ensures that you’re up-to-date with your taxes throughout the year, making your annual submission smoother.

Check full view of BIR Form 1701Q here.

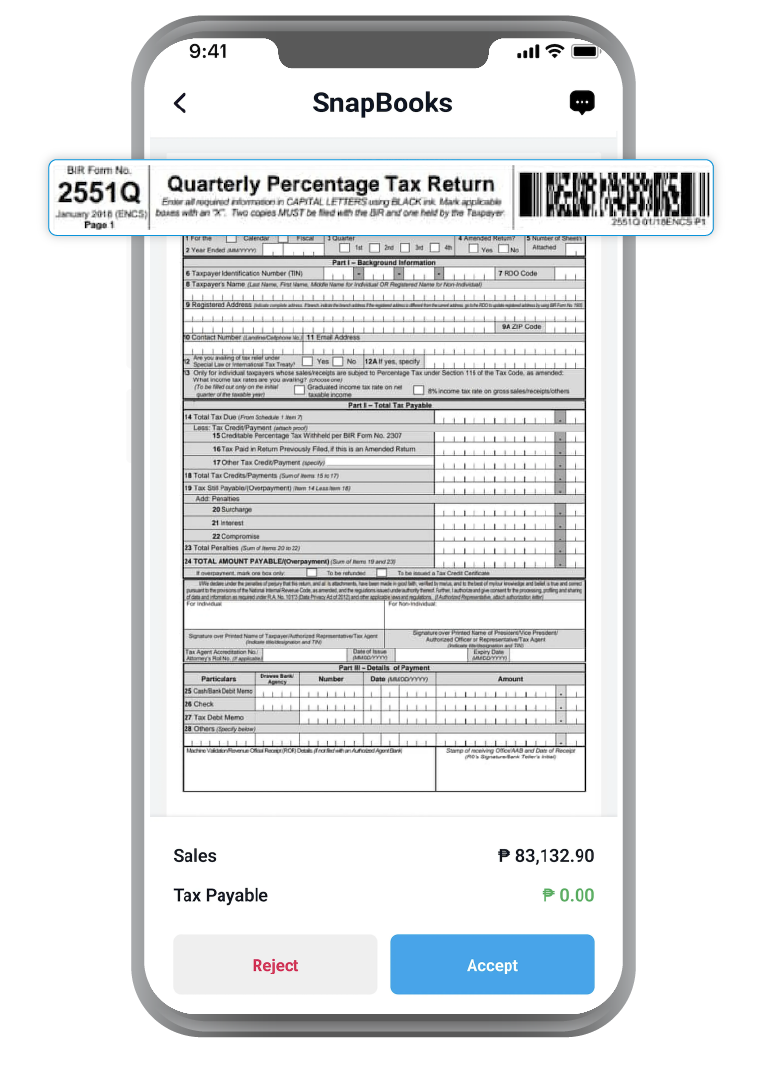

BIR Form 2551Q

If you’re among the self-employed who pay a percentage tax instead of VAT, the BIR Form 2551Q is for you. This form is filed quarterly, keeping your percentage tax submissions in check.

Check full view of BIR Form 2551Q here.

BIR Form 0605

Sometimes, you have payments not tied to specific filings—maybe it’s a penalty or a particular fee. In such cases, the BIR Form 0605 is your go-to. This form is versatile and covers a range of payments beyond the usual tax submissions.

Check full view of BIR Form 0605 here.

Handling taxes becomes simpler with the right help and understanding. Beppo provides both human and tech-driven solutions for all your bookkeeping and tax-related tasks. Whether you prefer to do it yourself or are just too lazy to do it, Beppo is committed to simplifying the process for you.