The freedom to choose your clients, determine your hours, and truly own your work can be an exhilarating experience. But with freelancing comes the often complex, sometimes daunting task of managing your finances.

Suddenly, you’re not only your own boss, but also your own accountant, tasked with keeping track of who owes you what, when, and how. If you just started freelancing, you must know that having a well-structured system of billing clients for your work is crucial. This is where invoicing comes in.

In hindsight, invoicing is the process of sending a bill for services rendered. But in reality, it’s much more than that. A good invoice can serve as a communication tool, a reminder, a legal document, and a record of your business dealings. An invoice makes it easier to see who owes you what, potentially leading to lost income and financial stress.

This article introduces invoicing and why you need it to run a successful freelance business.

[lwptoc]What is an Invoice?

In its simplest form, an invoice is a document that a freelancer or service provider issues to a client that outlines the specifics of a job or project, detailing the services rendered, the pay rate, the total amount due, and the payment due date. An invoice serves as a bill and a legal document that validates your agreement with your client.

Beyond its primary role as a payment request, an invoice also aids in record keeping. It helps you track your earnings, manage cash flow, and prepare taxes. Moreover, in a payment dispute, an invoice is a crucial piece of evidence to help resolve the issue.

What Are the Different Types of Invoices?

Invoicing isn’t a one-size-fits-all process. Depending on the project and payment terms, you may use different invoices. Check out our list below.

- Standard Invoice

The Standard Invoice is the most common type of invoice used by freelancers. It includes the basic details of a transaction, like the services provided, the amount due, the issue date, and the payment due date. These invoices are straightforward and are typically used for a single, complete job or project.

- Credit Invoice

A Credit Invoice is issued when a freelancer needs to provide a refund or discount to a client. This could be due to an overcharge, a returned product, or a service not rendered as promised.

- Debit Invoice

A Debit Invoice, contrary to a Credit Invoice, is issued when a client owes an increase in the amount. This might occur if there’s been an undercharge or if you did any additional work that your original invoice should have included.

- Mixed Invoice

A Mixed Invoice is a combination of a Credit and Debit Invoice. It is used when additional charges and refunds must be accounted for in a single invoice. These invoices are especially useful for complex projects where multiple adjustments may need to be made over time.

- Commercial Invoice

Commercial Invoices are typically used by those involved in international trade, where goods or services are sold across borders. These invoices are crucial for calculating customs duties and taxes. They act as transaction records and can also prove ownership of the goods you ship.

- Timesheet Invoice

A Timesheet Invoice is ideal for freelancers who bill their clients depending on the number of hours worked during a specific period and the hourly rate. These invoices provide a clear and thorough record of work done, making them perfect for projects where payment is based on time spent.

- Expense Report

An Expense Report outlines any out-of-pocket expenses you’ve incurred while completing a client’s project. These expenses range from travel costs, software subscriptions, and equipment purchases to minor costs like stationary – essentially, any expense you’ve had to shoulder while executing the project.

- Pro Forma Invoice

A Pro Forma Invoice is a quote given to a client before the work begins. It outlines the estimated cost of the services to be provided. These invoices help set expectations for the client and allow them to prepare for the cost in advance.

- Interim Invoice

Interim Invoices are used for larger projects that span over a long period. Instead of billing for the entire project at once, you can send interim invoices at different project milestones. These invoices help you maintain a steady cash flow and make payments more manageable for your client.

- Final Invoice

A Final Invoice is sent upon the completion of a project. It includes the project’s total cost minus any payments already made through interim invoices or deposits. This invoice signifies the end of a project and requests the final payment.

- Past Due Invoice

A Past Due Invoice is sent when a client fails to pay by the original invoice’s due date. It includes the actual amount owed, any late fees, and a new due date for payment. Sending a Past Due Invoice is a professional way of reminding a client about an overdue payment.

- Recurring Invoice

Recurring Invoices are used for ongoing services or retainer agreements. They are sent on a regular schedule, such as weekly, monthly, or quarterly, for a set amount. This type of invoice is highly beneficial for freelancers with an ongoing relationship with a client, as it streamlines the billing process and ensures consistent, predictable revenue.

E-Invoice

An E-Invoice is a digital invoice sent and processed electronically, providing an instant, environmentally-friendly way for freelancers to bill clients. It simplifies the payment process as clients can pay online via various methods. Moreover, E-Invoices streamline invoice tracking and organization, reducing the likelihood of misplaced or unpaid invoices.

How to Invoice as a Freelancer?

Mastering the art of invoicing isn’t just a nice-to-have skill—it’s a crucial part of your professional survival. It’s the key to getting paid for your hard work, maintaining healthy client relationships, and keeping your financial records in order.

Proper invoicing ensures that you get compensated for your hard work and helps you maintain a solid financial record, which is crucial for your business growth and tax obligations. But how exactly do you navigate this aspect of freelancing? Check out your options below.

Manual Invoicing

With manual invoicing, you’ll create invoices on paper or through digital tools like Microsoft Excel or Google Sheets. This method gives you complete freedom over the design of your invoice and the information included.

To start, you’ll need to list basic details such as your name, contact information, client’s name and details, a unique invoice number, the date, and a comprehensive list of the services you’ve provided with their corresponding costs. Once done, calculate the total cost, apply the taxes or discounts, and specify the payment due date and your preferred payment method.

On the flip side, manual invoicing comes with a few drawbacks. It’s susceptible to human error, like miscalculations or omissions, and it’s less efficient as it demands more time and effort from you. Plus, keeping track of payments can become increasingly challenging as your client base expands. You’ll have to devise a system for organizing and storing your invoices and remember to follow up on any unpaid invoices on time.

Hire an Accountant

If you hire an accountant, you’re investing in a time-saving solution. Accountants are experts in the financial realm who can manage your invoicing and other aspects of your business finances like bookkeeping, tax preparation, and financial planning. They have the experience, skills and knowledge to ensure your invoices are accurate, professional, and compliant with any pertinent laws or regulations.

However, remember that hiring an accountant can be costly, so evaluating whether the benefits justify the cost in your particular situation is vital. If you’re starting your freelancing journey or have a smaller client base, other cost-effective options might be worth considering.

Automatic Invoicing (Software)

Using finance or invoicing software could be an excellent balance between manual invoicing and hiring an accountant. These tools automate many facets of invoicing, saving you time and reducing error chances. They can automatically generate invoices, track payments, and even send reminders for unpaid invoices.

This is why freelancers trust the Beppo App in the Philippines: This one-stop-shop digital financing platform helps you send invoices to clients through SMS, email, or Viber, track your income and expenses, estimate and pay your taxes, and automate your budgeting.

The best part is Beppo gives you quick access to experts who can provide assistance in preparing your taxes. That means you don’t have to hire your own accountant to stay on top of your tax obligations.

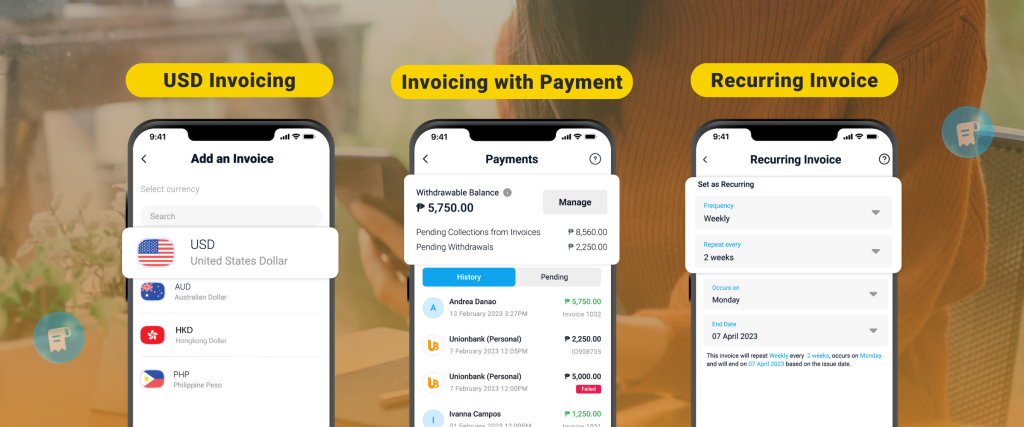

Beppo offers three advanced invoicing features that can support your needs: recurring invoice, invoicing with payment, and USD invoicing.

Recurring Invoice

A recurring invoice is a feature that can save you significant time and effort. Imagine you’re working with a client on a long-term basis, and you provide the same services each month. Instead of creating a new invoice every time, you can set up a recurring invoice. Once you set the parameters for the first time, Beppo will automatically generate and send the invoice to your client at the intervals you specify.

Invoicing with Payment

Invoicing with payment integrates a secure payment gateway directly into your invoices. This means that when your clients receive your invoice, they can conveniently pay you right away with just a few clicks.

USD Invoicing

USD invoicing allows you to create and send invoices in US dollars (USD), regardless of your local currency. This feature is particularly useful if you have international clients or work with businesses that prefer transactions in USD.

The Relevance of BIR Form 2307

As a freelancer, collaborating with clients often involves withholding taxes. Clients issue BIR Form 2307, the Certificate of Final Tax Withheld at Source. This form is crucial, indicating the final taxes withheld by clients from your income payments. It’s essential for accurate tax reporting and compliance.

Why BIR Form 2307 is vital for freelancers

Ensuring proper accounting for taxes already withheld when filing income tax returns. This certificate acts as evidence of paid taxes, contributing to the overall tax liability at the fiscal year-end.

Invoicing and understanding tax-related documents like BIR Form 2307 go hand in hand, providing freelancers with a comprehensive approach to financial management in their independent ventures.

What Should Freelancers Include on Their Invoice?

- Your Name and Contact Info: This should include your full name or your business name, your address, phone number, and email. This information helps the client know who the invoice is coming from and allows them to contact you for any queries or issues.

- The Client’s Info: You should include the client’s name and contact information like your own. This ensures the invoice reaches the correct person or department within the client’s organization and helps avoid confusion or payment delays.

- A Unique Invoice Number: Each invoice should have a unique number for identification purposes. This helps track and organize your invoices and is especially helpful if a payment issue arises. The system you use to number your invoices will depend on your style, but it should allow you to identify each one easily.

- Issue Date/Due Date: The issue date is when the invoice is sent, and the due date is when the payment is expected. Clearly stating both these dates helps to establish when payment is due and can help avoid any misunderstanding about payment terms.

- Description: This is the detailed description of the services you have provided or the work you have done. Each service should be listed as a separate line item, with a brief description and associated cost. This clarifies to the client what they are being charged for and helps them understand the total cost.

Total Amount Due: This is the total cost the client needs to pay. If applicable, it should include any taxes or additional fees. If you’ve received a deposit or the client has made previous payments towards this invoice, those amounts should be deducted from the total.

Common Mistakes to Avoid When Invoicing

Invoicing is essential to managing your freelance business, but it’s easy to make errors if you’re not careful. Here are the common mistakes you need to avoid when invoicing, along with tips on how to sidestep them.

1. Putting Off Sending Invoices

Procrastination can be your worst enemy when it comes to invoicing. The longer it takes you to send an invoice after completing a job, the longer it takes to get paid. Make it a habit to send invoices promptly after work completion.

2. Getting the Wrong Information

Double-check the details on the invoice and make sure they are accurate, both yours and the clients’. Any errors can lead to delays or non-payment. Always double-check the information before sending out an invoice.

3. Sending the Invoice to the Wrong Person

You must send the invoice to the correct person or department to ensure timely payment. Don’t hesitate to ask your client if you need help deciding who to send it to.

4. Generating a Vague Invoice

A clear, detailed invoice leaves no room for confusion. Ensure you itemize each service provided and its cost. Be more specific with the details of your invoice to avoid misunderstandings.

5. Providing Incorrect Payment Information

Your invoice should include clear instructions on how to make a payment. Incorrect or missing payment information can cause delays. Always verify your payment details before sending the invoice.

6. Reusing Invoice Numbers

Each invoice should have a unique number for easy tracking and organization. Reusing invoice numbers can lead to confusion and misapplied payments.

7. Forgetting to Include Your Correct VAT Number

If you’re registered for VAT, include your correct number on the invoice. Forgetting to do so or including an incorrect number can lead to legal issues and delays in payment.

8. Failing to Follow-Up

Sometimes, clients need a gentle reminder to settle their dues. If a payment is overdue, don’t hesitate to send a friendly follow-up email.

9. Using Tacky and Unprofessional Invoices

An invoice is a reflection of your professionalism. Avoid using unprofessional, tacky invoice templates. Instead, choose a clean, simple design that looks professional and is easy to read. Beppo has template options for you to choose from.

10. Not Using the Right Kind of Invoice

Different types of invoices are used for different situations. Make sure you’re using the most appropriate one for the job. For example, an interim invoice might be appropriate if you’re billing for an ongoing project.

Quick Tips for Creating invoices–and getting paid on time!

When done right, invoicing can significantly streamline your cash flow. Here are some quick tips for you.

- Create a detailed invoice – Your invoice should include your name, contact information, unique invoice number, the client’s name and address, a detailed breakdown of services provided, the total amount due, the invoice due date, and the acceptable payment options. Remember, clarity is critical. The less your client has to guess, the smoother the payment process.

- Send invoice on time – The sooner you send the invoice after completing a job, the sooner you’ll get paid. Set a specific schedule to handle all your invoicing. This routine can help ensure you always remember to bill for a project.

- Set a payment due date and payment terms – Determine when you expect your invoices to be processed. You can either mention that the payment is due within 30 days or upon receipt of the invoice. Setting a clear expectation helps prevent misunderstandings and encourages timely payment.

- Use online payment solutions – Remove the hassle of processing, sending and managing your finances. Beppo has been designed to help you automate and simplify your financial management–invoicing included!

Invoicing isn’t just a formality. It’s your key to growth

Often, many freelancers overlook the significance of invoicing, with many assuming it’s either too complicated or just a formality. This misconception can result in delayed payments, confusion, and even disagreements with clients.

When you have a well-organized invoice, its benefits can be transformative. It provides a clear record of transactions and facilitates timely payment, fostering a professional relationship between you and your clients.

Get started on simplifying your invoices. Connect with Beppo to know more. Or visit our website https://beppo.com.