Many Filipinos start working as a freelancer on top of their full-time careers. But if you think you’re ready to begin your journey towards running your own legal freelance business, this guide is for you.

Registering yourself as a sole proprietor legitimizes you as a full-fledged business that abides by government regulations and compliance requirements.

BIR registration is essential, but it doesn’t have to be complicated. With the right tools and help, you can navigate the process smoothly and focus on what you do best – growing your business.

This article will uncover everything you need to know when legalizing your freelance business and how to do it in the Philippines.

What Does It Mean to Legalize Your Business?

Legalizing your freelance business entity means registering it with the appropriate government agencies and complying with the necessary laws and regulations. In the Philippines, this typically involves registering with the Bureau of Internal Revenue (BIR).

The requirements and procedures for obtaining a business permit vary depending on the LGU, so you may need to check with your local government office for more information.

Why Should You Legalize Your Freelancing Business?

There are several reasons why freelancers should register their operations. Here are some of them:

1. Protect your personal assets

Operating your freelance business as an unregistered entity risks your personal assets. If you have business-related debts or legal issues, creditors or litigants can go after your assets to settle the debts or judgments against you.

By legalizing your business, you can create a separate legal entity with its liabilities and obligations, shielding your assets from any business risks.

2. Comply with legal requirements

Running an unregistered business in the Philippines is illegal and can lead to penalties and fines. The government requires all businesses to register with the BIR and secure a business permit from the LGU where the business is located.

Compliance with these requirements ensures that you operate your business legally and avoid any legal complications that may hurt your finances and reputation in the long run.

3. Establish credibility

Legalizing your freelance business helps you establish credibility with clients and customers. Many clients prefer to work with registered businesses as they perceive them to be more reliable, professional, and trustworthy.

Registering your business can help you present a more polished image to your target market, leading to more business opportunities and higher rates.

4. Access financing options

One of the benefits of running a fully legal business is the abundance of access to financing options that most unregistered businesses don’t have. Banks, financial institutions, and government agencies may require proof of business registration and tax compliance before extending loans, grants, or subsidies.

If your business is registered, you can raise capital and expand your operations when growth demands it.

5. Reduce tax liability

Legalized businesses in the Philippines can take advantage of tax incentives, exemptions, and deductions that can lower their tax burden. The BIR recognizes registered businesses as legitimate taxpayers and provides them with more tax breaks than unregistered entities.

6. Enjoy legal protection

A legalized business gives you legal protection in case of disputes or conflicts. For example, if someone sues your freelance business, you can defend your rights and interests through lawful means. You can also enforce your contracts and agreements more effectively when you operate as a legal entity.

In short, a legitimate freelance business can help you establish a professional and credible reputation while protecting your business assets. It also opens many doors to grow your network and expand your operations.

7. Contribute to the economy’s growth

Since freelancers are legally obligated to pay taxes, they can help to fund government projects and initiatives that support economic growth and development. The government uses tax revenues to fund public goods and services such as infrastructure, public education, healthcare, defense, and social welfare programs. In return, they get to enjoy public infrastructure and services such as social security and healthcare.

Freelancing Business Registration Full Guide 2023

Starting a freelance business in the Philippines can be exciting and rewarding. However, before running your business, you must register it with the appropriate government agencies and comply with the necessary laws and regulations.

Here’s the step-by-step process of registering your freelance business in the Philippines in 2023.

Requirements when registering your freelance business

1. Your Taxpayer Identification Number (TIN)

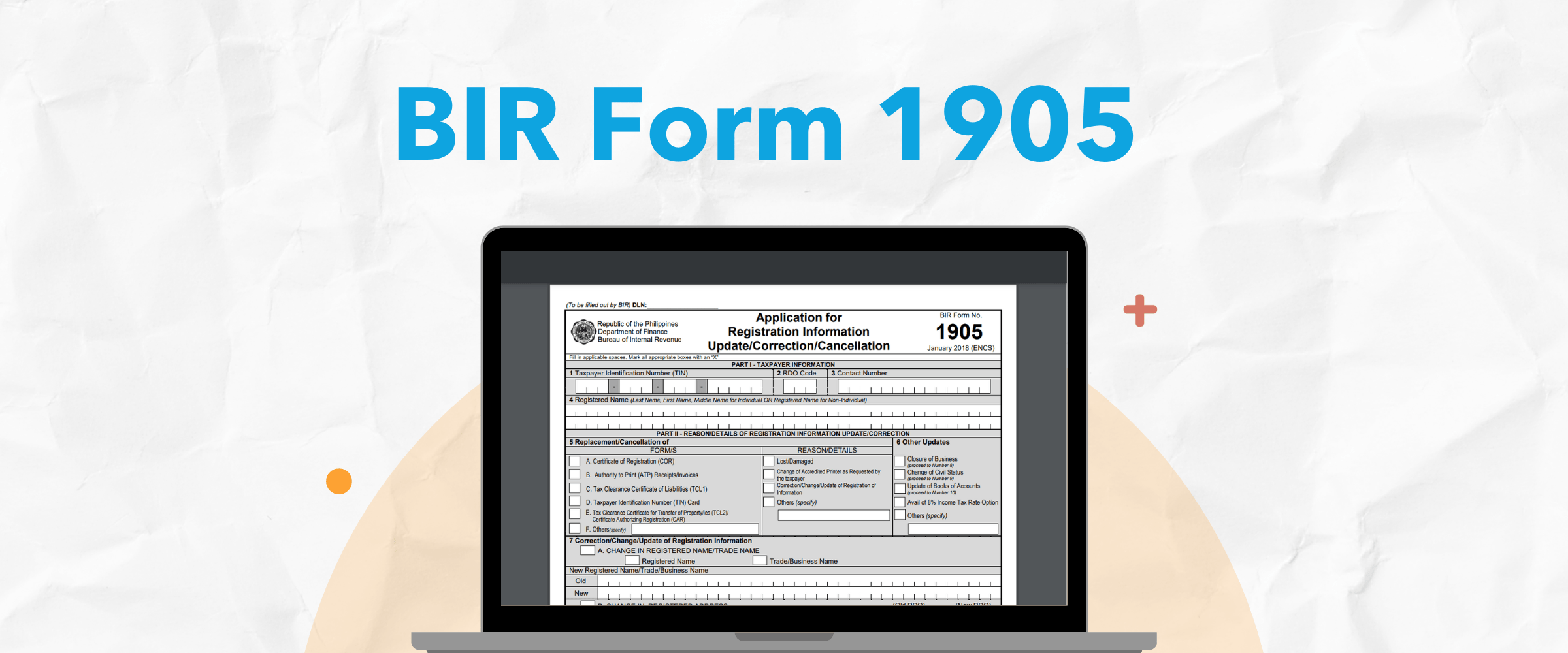

You no longer have to visit your old RDO when registering your TIN. This is especially helpful if you’re working from home and your existing RDO is far from your location. Process the transfer of your old RDO to your new RDO by bringing two (2) copies of BIR Form 1905 to your preferred RDO.

If without TIN:

If you don’t have a TIN yet, you can apply for a TIN online, or head to your nearest RDO.

How to register for a TIN online:

Step 1: Prepare the following documents:

- Valid email address

- Accurate profile details

- Fast internet connection

Step 2: Go to the BIR eReg page. Simply click this link: https://ereg.bir.gov.ph/init.do;jsessionid=794F9293E04C394F60FE540B7D343561?app=ereg.

Step 3: Enter your personal information. Make sure you don’t leave any spaces blank.

Step 4: Review the personal details you provide and click Submit.

Step 5: Wait for an e-mail from the BIR confirming the status of your TIN.

Do note that this applies to those who will be getting their TIN for the first time. Usually, the TINs are provided by your first employer. Also, you can only have one TIN for life.

NOTE: As of writing, the BIR eReg website is currently under service maintenance. For the meantime, new applicants are required to go to the nearest RDO to apply for a TIN.

How to register for a TIN in your nearest RDO:

Step 1: Bring the following documents:

- A duly accomplished BIR Form No. 1901 version 2018

- Any proof of identification that shows your full name, address and birthdate (passport, OWWA e-card, UMID, PRC ID, etc).

- Payment fee of P500.00 for the registration

- 1×1 picture

- PSA birth certificate

- Community tax certificate or Cedula

- For married women, please bring your PSA marriage certificate

Step 2: Go to your nearest RDO and submit your requirements

Step 3: Wait for the RDO personnel to issue the Certificate of Registration (Form 2303) along with the ‘Notice to Issue Receipt/Invoice’, Authority to Print, and eReceipt.

2. Occupational Tax Receipt

You may get your occupational tax receipt from your Municipal Hall. Just bring two valid IDs and P450.00 for the fees. The actual fee may vary depending on your Municipality.

3. A photocopy of your valid ID with your birth date and current address

Secure two copies of your valid ID with your updated personal information. Remember to bring your actual valid IDs, just in case.

4. A duly completed BIR Form 1901 – Application for Registration

Print two (2) copies of your duly accomplished BIR Form 1901 version January 2018.

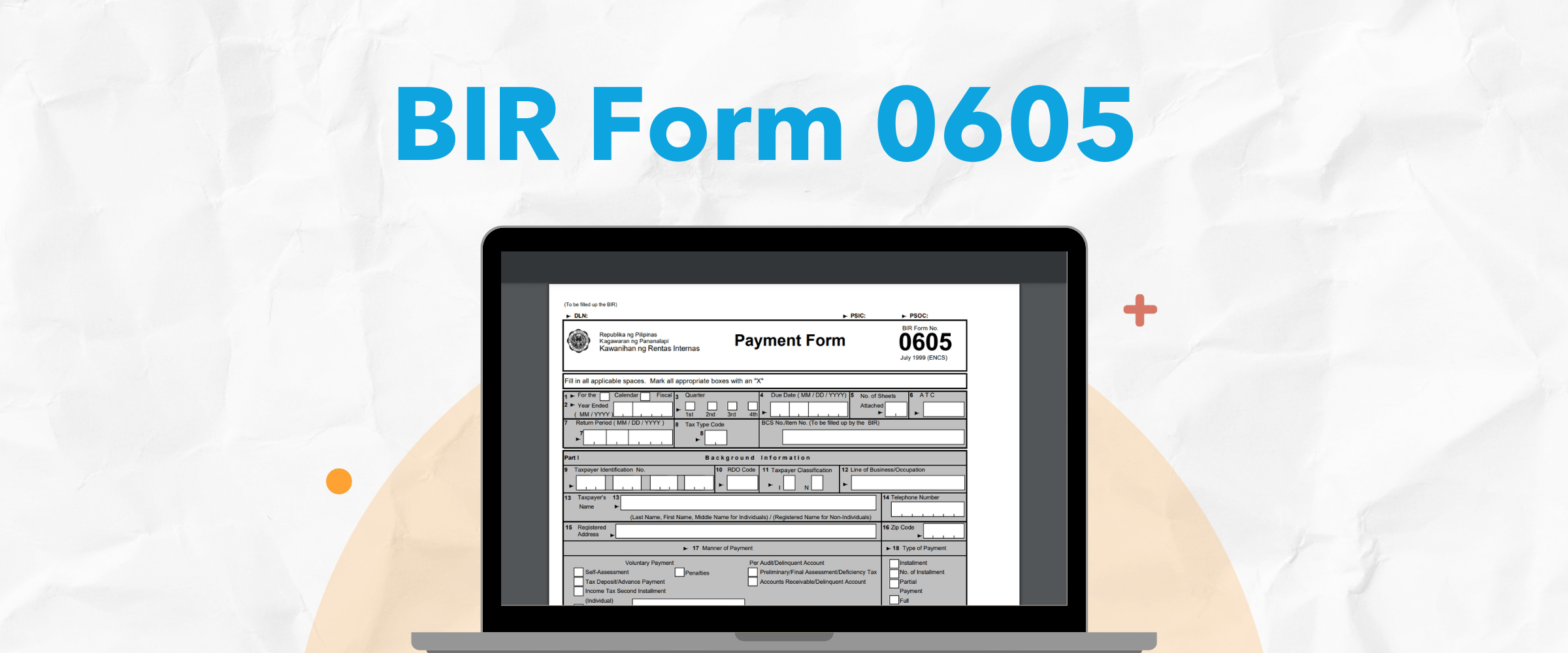

5. A duly completed BIR Form 0605 – Annual Registration Fee

You may pay the annual registration fee of P500.00 via GCash or bank transfers.

Step 1. Download and install the eBIR by visiting this website: https://www.bir.gov.ph/index.php/eservices/ebirforms.html

Step 2. Choose BIR Form 0605 – Payment Form and click Fill-up.

Make sure to fill out these fields:

- TIN

- RDO code

- Line of business

- Registered name

- ZIP code

- Email address

- Calendar/fiscal year

- Due date

- ATC

- Return period

- Tax type

- Individual or non-individual

- Manner of payment

- Amount

Step 3. Confirm if all the details are correct, then click Validate.

Step 4. Save the form and submit.

Step 5. Print three (3) hard copies of the BIR Form 0605.

Step 6. Wait for the BIR to send you a confirmation e-mail. This usually takes 24 hours.

Step 7. Pay using GCash, then print and attach the proof of payment to every BIR Form 0605.

You can also pay through an authorized accredited bank (AAB) if you want to go through the traditional process. Just bring your printed forms and a hard copy of the confirmation email.

6. A duly completed BIR Form 1905 – For Registration of Books of Accounts

You can buy your ledgers from office supplies stores. Once this is done, you will be given the following:

- General Journal

- General Ledger

- Cash Receipt Book

-

Cash Disbursement Journal

7. A duly completed BIR Form 1906 – Application for Authority to Print Receipts and Invoices

This form is for printing of your official receipts (O.R.). There are 50 receipts per booklet. The BIR will require you to purchase a minimum of 10 booklets, which costs around P1,500 to P2,000.

8. A letter with your intent to avail the 8% Tax Option (check this guide for more info)

Prepare one (1) copy of your intent to avail the 8% tax option.

9. DTI Certificate of Business Name Registration (optional)

You don’t have to go to the Department of Trade and Industry (DTI) to register your business name. You can simply go to https://bnrs.dti.gov.ph/registration to register your business, and pay the fee online via GCash. The certificate will be sent to your email in PDF format.

If you choose not to register your business name (as this is optional), your business name will be your full name.

10. Special Power of Attorney

If you want someone else to process your business registration, you will need a special power of attorney. This can be beneficial for those who need to focus their time on freelancing.

Obtaining a License for Your Freelance Business

Once you have all the documents with you, it’s time to proceed with the actual application process.

Step 1: Check if your RDO is now accepting online appointments.

Step 2: Once you have a schedule, proceed to the RDO nearest to you.

Step 3: Go to the window assigned for New Business Registration and submit all your documents.

Step 4: Ask the BIR officer to help process your official BIR receipts. You will need to prepare your BIR Form 1906 to proceed.

Step 4.1. The BIR officer will inform you on what date you can claim your BIR Certificate of Registration. This can be completed within one to two business days.

Step 4.2. Once you picked up your BIR Certificate of Registration and Official Receipts, bring the four books of accounts and the BIR Form 1905.

Step 4.3. Register the four books and have them stamped and signed by the BIR officer that attends to you.

Step 5: Complete your BIR registration documents by submitting:

- BIR Certificate of Registration

- Four registered books of account (cash receipt book, general ledger, general journal, and cash disbursement journal)

- Official receipts (10 booklets)

- Copy of BIR Form 1901 – Registration Application

- Copy of BIR Form 1905 – Books

Understanding Your Tax Obligations as a Freelancer

Now that you are considering becoming a legitimate business, you must know that filing your taxes as a self-employed individual is mandated by the government.

Filing your taxes as a freelancer may not be the most exciting part of running your own business, but it is an essential task that should not be overlooked. Here are a few reasons why it’s important to know your tax obligations as a freelancer:

Why pay your taxes as a freelancer

- You get to comply with government requirements. Complying with your tax obligations is a legal requirement. Failing to pay your taxes or file your tax returns can result in fines and even legal action. By meeting your tax obligations, you can avoid these consequences and ensure that you operate your business lawfully and ethically.

- You avoid penalties and interest charges: If you fail to file your taxes or pay the amount owed by the deadline, you could face penalties and interest charges from the government. These can add up quickly, making it harder for you to manage your finances.

- You gain a better understanding of your finances: Filing your taxes requires you to keep detailed records of your income and expenses, which can benefit your business. When you track your finances, you can better understand your cash flow, revenue, and costs, and therefore help you make more informed decisions.

- You establish credibility with clients: Clients want to work with professionals who take their work seriously and are recognized by the government as a legitimate business. Keep up with your tax obligations to demonstrate professionalism and business commitment.

How to pay your tax obligations

Every first quarter of the year, you need to file the following BIR Tax Forms:

- BIR Form 1701Q1v2018 – Quarterly Income Tax Return

- BIR Form 2551Qv2018 – Quarterly Percentage Tax Return

Here’s the step-by-step process:

- Prepare a summary of your total income for the first quarter (January to March)

- Get your latest eBIR. You may get it by filling out the form: https://www.bir.gov.ph/index.php/eservices/ebirforms.html

- Get a BIR Tax Return Receipt Confirmation, upon filing the BIR Form 1701Q1v2018

- Pay your fees using GCash and save your payment receipt for future reference.

- File your BIR Form 2551Qv2018

- Update your cash Receipt Book using your income summary as basis

- Repeat the process quarterly.

- At the end of the year, you may need to prepare your Annual Income Tax Return. Just repeat the same filing process, except this time you will need the summary of your total income for the full year (January to December).

Protecting your Freelance Business with Liability Insurance

Liability insurance can protect you from financial loss if you are held responsible for any damages–from the client’s failure to pay their dues to intellectual property disputes. If a client or third party sues you for damages, liability insurance can help cover the costs of legal fees, settlements, and other expenses.

There are many benefits to protecting your freelance business with liability insurance. It can protect you from financial losses, build trust with clients, win more business, and give you peace of mind in case there are issues that need to be disputed.

If you’re considering to get a liability insurance, here are a few tips:

- Understand your risks. Consider the nature of your freelance business and the potential risks involved. For example, if you’re a web developer, you may want coverage for cyber liability in case a client’s website is hacked or your tools get compromised.

- Shop around for coverage. There are many different types of liability insurance available, so it’s important to shop around and find a policy that meets your specific needs.

- Check for exclusions. Be sure to read the policy carefully and understand any exclusions or limitations. Some policies may not cover certain types of claims or damages.

- Get enough coverage. Make sure you have the right coverage to protect yourself in case of a lawsuit or claim. Your coverage will largely depend on the nature of your work and the potential risks involved.

Finding Legal Resources and Support for Freelancers

While many freelancers work independently and handle most legal matters themselves, there are situations where legal support may be necessary. Here’s some guidance on how to find legal support in the Philippines:

1. Consider joining a freelancer association or union.

Freelancer associations or organizations often offer legal support and resources to their members. They can also provide information on legal issues relevant to freelancers in the Philippines.

2. Consult with a lawyer who specializes in business or labor law.

A lawyer can help you understand your legal rights and obligations as a freelancer and guide you on specific legal issues.

3. Seek free or low-cost legal assistance.

Look for legal aid organizations that offer free or low-cost legal services to low-income individuals, including freelancers. These organizations can provide legal advice or representation if you face a legal issue.

4. Leverage online resources.

Use online resources to learn about legal issues relevant to freelancers. Many legal websites offer articles, resources, and FAQs related to labor and business laws that may apply to your business’s nature.

To know how you can leverage Beppo to your advantage, Connect with Beppo: https://bit.ly/bookacall-beppo. Or visit our website https://beppo.com.