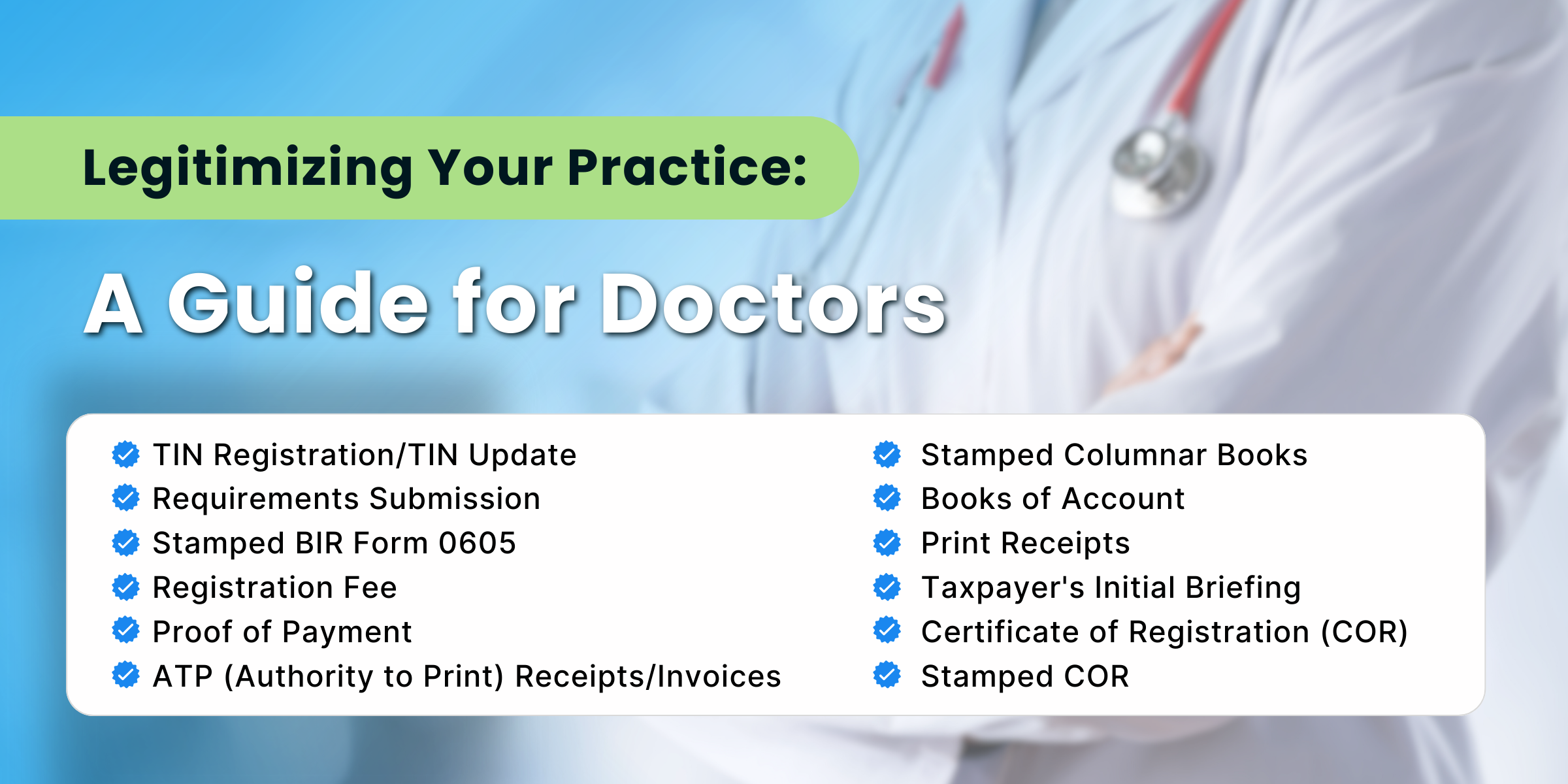

Registering your business is the hardest. If you want to DIY your business registration, here are 12 things you need to do to legitimize your practice.

The BIR registration process can be intimidating, especially for doctors and physicians with busy schedules. In this guide, we provide a detailed and comprehensive overview of how to register with the BIR as a doctor or physician. While our focus is on healthcare professionals, this guide can also be useful for other self-employed individuals and professionals.

Here’s a list of the general registration requirements for doctors and physicians

General Registration Requirements for Doctors/Physicians:

- NSO Birth Certificate or any government-issued valid ID displaying your name, address, and birthdate (Original and Photocopy)

- BIR Form No. 1901 (3 copies)

- BIR Form No. 1906 (3 copies)

- Final and clear samples of Principal Receipts and Invoices

- BIR Form 0605 (4 copies)

- Proof of Payment from BIR Form 0605 (original and photocopy)

- Proof of Address

- PRC license/ID

- Payment of Professional Tax Receipt

- Tax Identification Number (TIN)

Additional Documentary Requirements (Dependent on Your Taxpayer Category)

For Self-Employed Physicians:

- BIR Form 1906

- 2 columnar books

- DTI Certificate of Business Name (original or photocopy)

- Contract of Lease

- Mayor’s Business Permit

- Certificate of Employment

- If applicable: Marriage Contract (if married), Photocopy of birth certificate of dependents for tax deduction (Criteria: minimum of 4 children, all children must be below 21 years old)

For Mixed-Employed Physicians:

- BIR Form 1906

- If applicable: Marriage Contract (if married), Photocopy of birth certificate of dependents for tax deduction (Criteria: minimum of 4 children, all children must be below 21 years old)

It’s important to categorize yourself correctly as either self-employed or mixed-employed to ensure you fulfill the necessary requirements.

Doctors and physicians may fall into different taxpayer categories, including employed, self-employed, and mixed-income earners. Resident and government doctors are often classified as employed and are typically exempt from the BIR registration process, as their employers (government or hospitals) handle it on their behalf. Most doctors who start a private practice are considered self-employed by the BIR. Mixed-income earners combine various sources of income, including private employment or their own businesses.

Additionally, verify your BIR Revenue District Office (RDO). Many self-employed and mixed-income earner physicians make the mistake of not ensuring that their TIN is registered in the correct BIR RDO. Your TIN should correspond to the RDO where you conduct or plan to conduct your business or professional service, not your previous place of work or where you initially obtained your TIN ID. If you need to transfer your TIN to the correct RDO, we provide more details in the 12-step guide below.

To save time, you can obtain BIR forms online. Ensure you print them in legal size (8.5″ x 14″). The following BIR forms are essential for the registration process:

- BIR Form No. 0605: Payment form

- BIR Form No. 1901 (page 1 and page 2): Application for Registration for Self-Employed

- and Mixed-Income Individuals

- BIR Form No. 1906: Application for Authority to Print Receipts and Invoices

- BIR Form No. 1905: Application for transfer of TIN, registration cancellation, new copy of Certificate of Registration, new copy of TIN card

As you proceed with your BIR registration, know that you’re not alone in this journey. Your time is valuable, and our goal is to make this process as efficient and stress-free as possible. Stay organized, stay informed, and don’t hesitate to seek professional advice when needed.