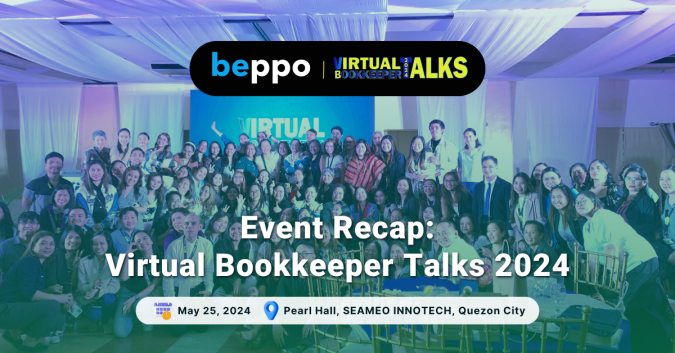

Event Recap: Virtual Bookkeeper Talks 2024

The Virtual Bookkeeper Talks 2024, held on May 25, 2024, drew hundreds of participants both online and onsite from the online bookkeeping and accounting communities. The Virtual Bookkeeper Talks has a thriving Facebook community of over 53,000 members and more than 2,500 students from the Bookkeeping Academy. Highlights of the Event: The event…