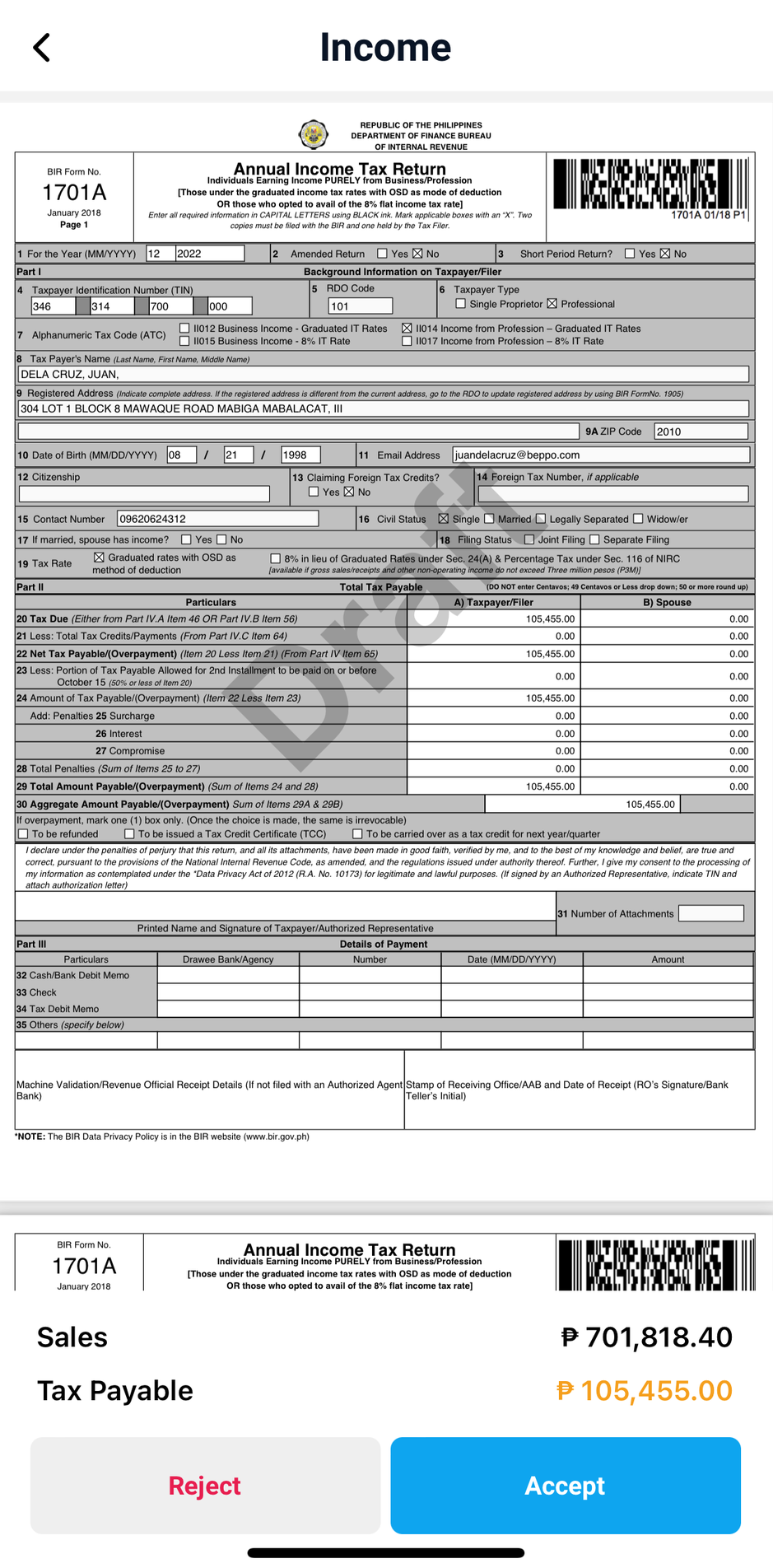

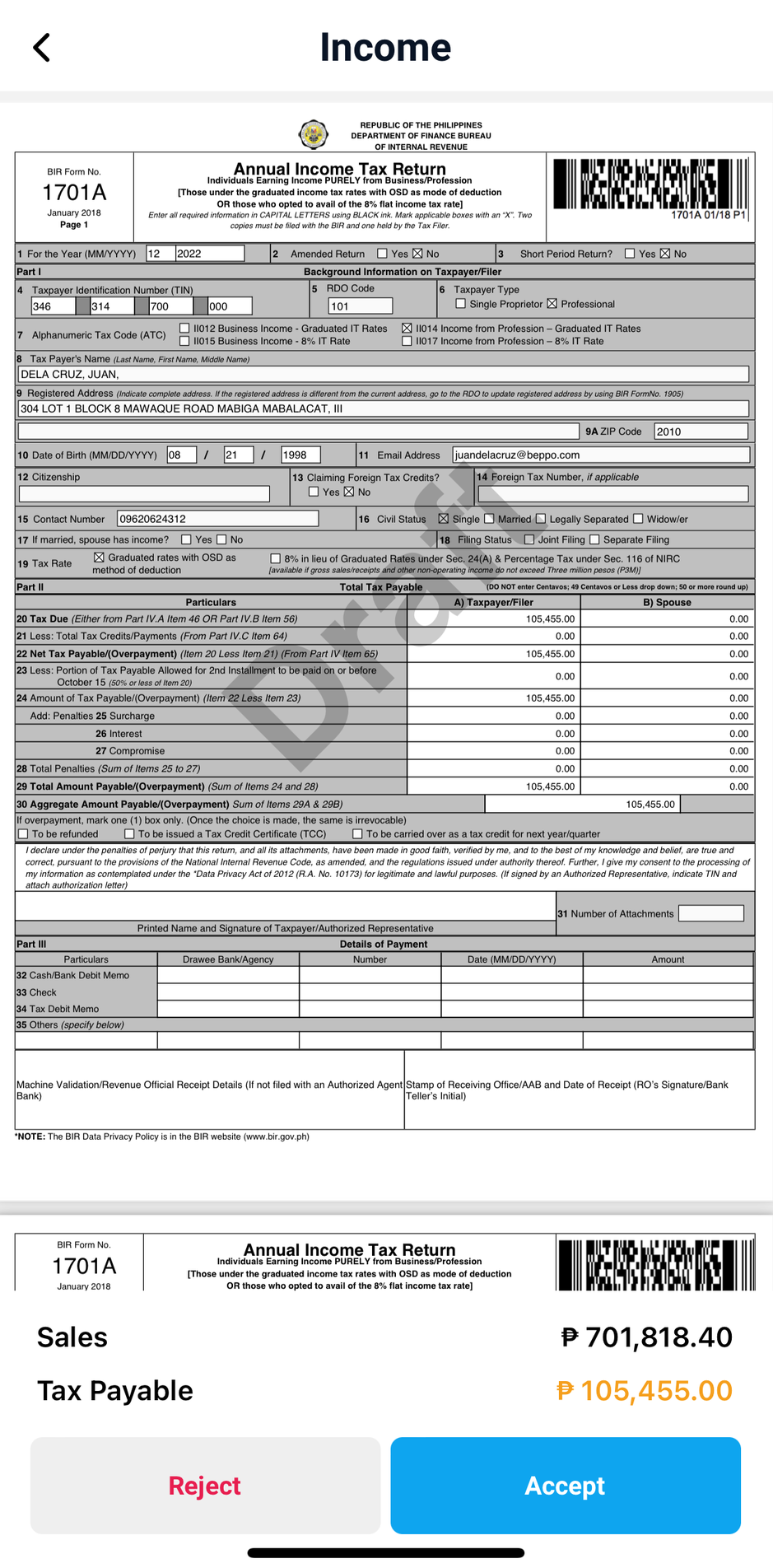

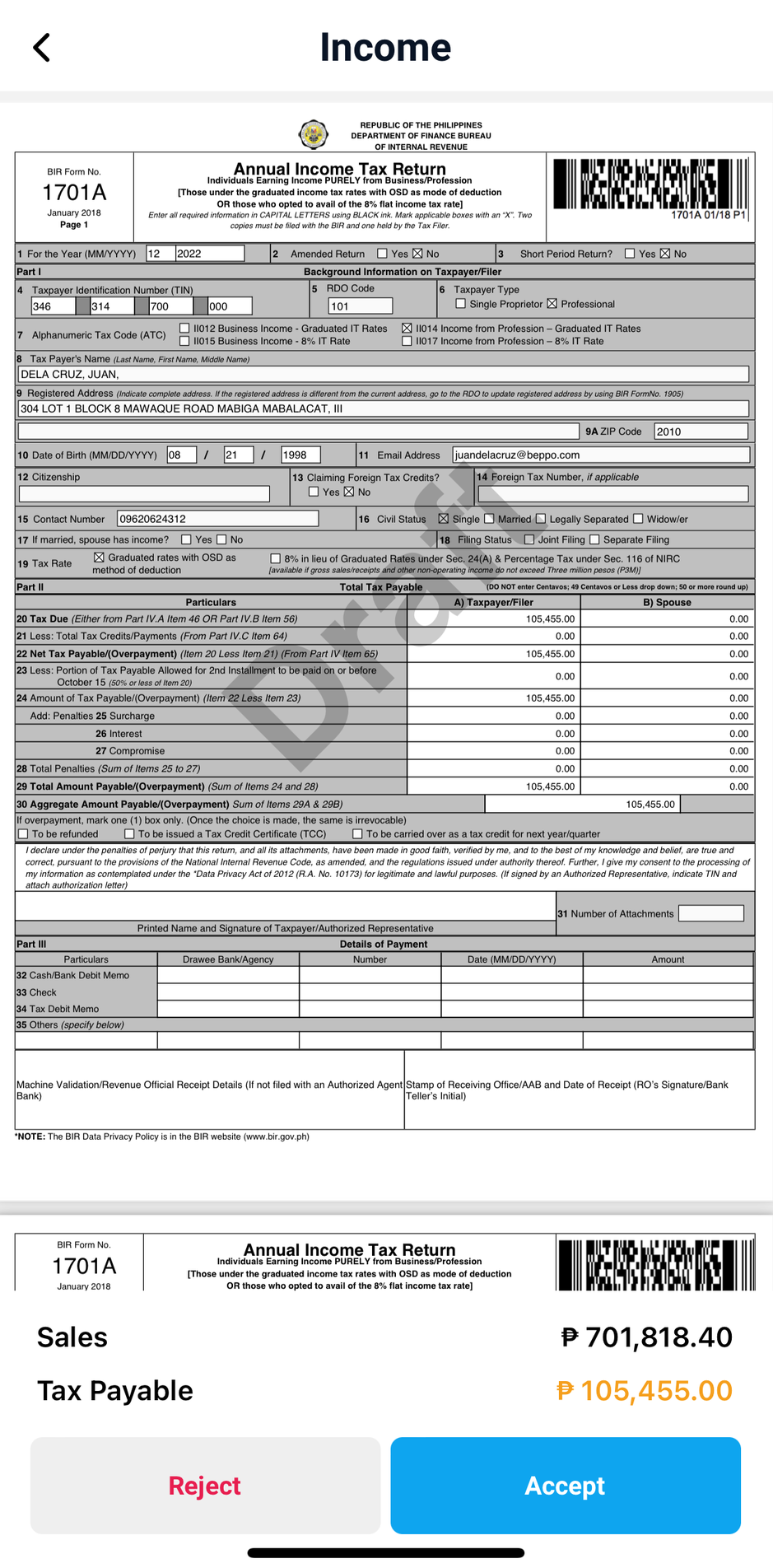

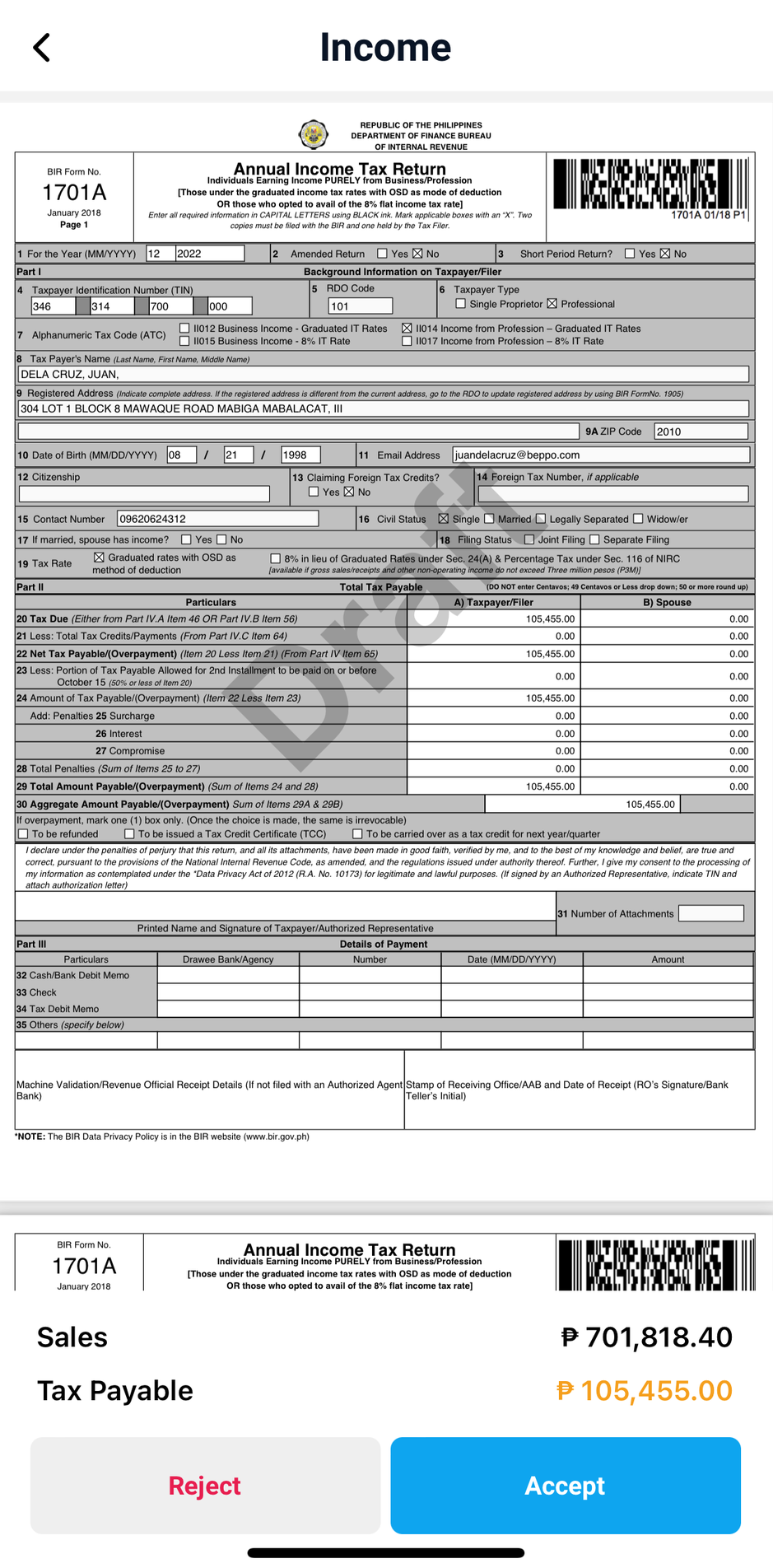

What is this form?

The Annual Income Tax Return applies to individuals whose income is SOLELY derived from business/profession, either falling under the graduated income tax rates with OSD as the deduction method or choosing to avail of the 8% flat income tax rate.

Who needs to file?

The return shall be filed by individuals earning income PURELY from trade/business or from the practice of profession, to wit:

1. A resident citizen (within and without the Philippines);

2. A resident alien, non-resident citizen or non-resident alien (within the Philippines).

The return shall only be used by said individuals as follows:

A. Those subject to graduated income tax rates and availed of the optional standard deduction as method of deduction, regardless of the amount of sales/receipts and other non-operating income; OR

B. Those who availed of the 8% flat income tax rate whose sales/receipts and other non-operating income do not exceed P3M.

When to file?

The deadline to enter all your transactions for Beppo is ten (10) calendar days after the quarter has closed.

Beppo implements an internal deadline for tax filing services which is different from the deadlines set by the Bureau of Internal Revenue (BIR). This is done to ensure that the filings and/or payments will be made on time.

Thus, the interval between the deadline of Beppo and the BIR is the time where we process your returns for your approval.

How to file?

It’s like having your own bookkeeper, but better! Beppo will keep you on the loop:

- If you have zero tax dues, we will file your tax returns for you!

- If you have a tax due, we will prepare your tax form for your review and you may simply approve the form and pay your taxes in the Beppo app.

- Payment channels accepted for tax payments in Beppo – Credit Card, Maya, UnionBank. Coming Oct 1, 2023: BDO, BPI, Metrobank, RCBC, and Landbank